ETH Price Prediction: Analyzing the Path to $10,000 Amid Mixed Signals

#ETH

- Technical Consolidation: ETH trades below 20-day MA but shows bullish MACD momentum, with critical support at $4,055

- Whale Accumulation: Significant institutional moves including $646M staking and 150K ETH transfers indicate strong confidence

- Ecosystem Growth: Layer-2 adoption and stablecoin integration support long-term $10,000 price targets despite short-term ETF outflows

ETH Price Prediction

Technical Analysis: ETH Shows Mixed Signals Near Key Support

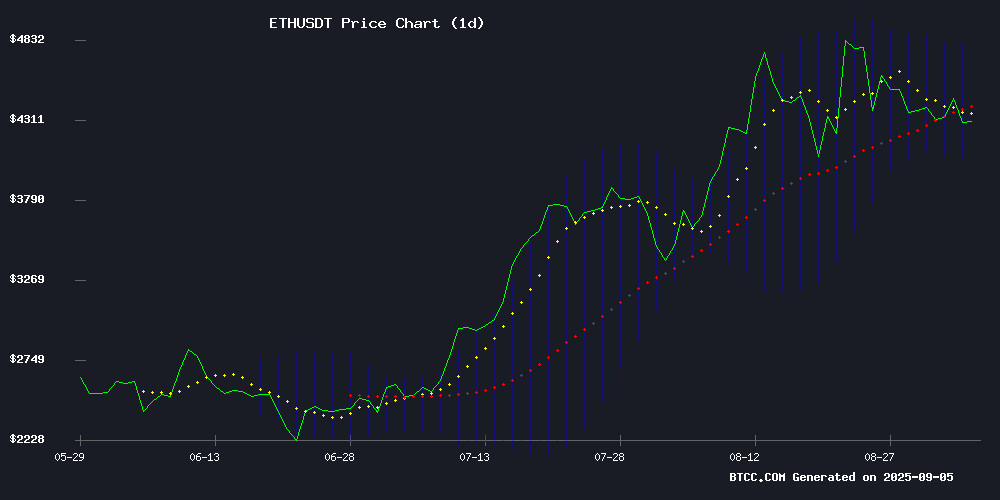

ETH is currently trading at $4,311.60, below its 20-day moving average of $4,431.70, suggesting potential short-term weakness. The MACD indicator shows bullish momentum with a positive histogram of 94.14, though both MACD line (37.51) and signal line (-56.63) remain in negative territory. Bollinger Bands indicate ETH is trading NEAR the middle band with support around $4,055.56 and resistance near $4,807.84. According to BTCC financial analyst James, 'The technical picture suggests consolidation around current levels with the $4,055 support being critical for maintaining bullish structure.'

Market Sentiment: Institutional Moves Contrast Retail Caution

Significant whale activity including a $646 million stake and 150,000 ETH moved to staking addresses indicates strong institutional accumulation despite ETF outflows. The pivot to Layer-2 solutions like Linea and growing stablecoin adoption support long-term bullish fundamentals. BTCC financial analyst James notes, 'While institutional ETFs face short-term outflows, the underlying whale accumulation and ecosystem development suggest confidence in Ethereum's $10,000 potential. The contrast between institutional positioning and retail seeking alternatives creates interesting market dynamics.'

Factors Influencing ETH's Price

Ethereum ICO Whale Stakes $646M as Price Holds Above $4.3K

An early Ethereum investor has reemerged with a seismic market move, staking 150,000 ETH worth $646 million. The funds originated from wallets dormant since February 2022, traced back to Ethereum's 2014 ICO where the whale initially acquired tokens at $0.31 apiece.

The staking deposit coincides with Ethereum trading at $4,325.35, marking a 1.20% daily gain. Remarkably, the investor retains an additional 105,000 ETH ($451 million) across two wallets. This positions their total holdings near $4.3 billion based on Lookonchain analytics.

Unlike recent whale transfers to exchanges like Kraken, this capital injection bolsters Ethereum's staking layer rather than creating sell pressure. The network's staked ETH now exceeds 33 million as legacy holders increasingly pursue proof-of-stake yields.

SharpLink to Stake $3.6B Ethereum on Linea Post-Mainnet Launch

SharpLink Gaming is diversifying its $3.6 billion Ethereum holdings by staking a portion on Linea, an Ethereum layer-2 network launching September 10. The firm currently stakes nearly all its ETH through custodians Anchorage and Coinbase but sees Linea as a strategic expansion. "When you hold billions in ETH, deploying through staking opportunities on Linea becomes viable," said co-CEO Joseph Chalom.

The move aligns with SharpLink’s broader strategy to support Ethereum-aligned projects. The company joined the Linea Consortium in July, which controls 75% of LINEA token distribution. Consensys, led by Ethereum co-founder Joe Lubin, designed Linea to enhance Ethereum’s utility with features like native yield and ETH burns.

Chalom emphasized that SharpLink’s staking approach—using both native and liquid staking tokens—aims to drive real-world activity on Ethereum, ultimately boosting its value. The firm remains in final discussions on its staking strategy, signaling a pivotal moment for its ETH portfolio.

Ethereum ETFs Face Sustained Outflows as Institutional Support Persists

Ethereum investment products have bled $167.41 million in a fourth consecutive day of outflows, with Fidelity's FETH fund leading the retreat at $216.68 million withdrawn. The exodus, ongoing since August 29, contrasts sharply with BlackRock's ETHA fund attracting $148.8 million in fresh capital—a divergence highlighting shifting institutional appetites.

Despite ETF headwinds, Ethereum's price floor at $4,275 suggests underlying strength. Strategic acquisitions by Bitmine and SharpLink Gaming demonstrate continued corporate confidence in ETH's long-term value proposition, even as short-term traders rebalance exposure.

SharpLink Gaming Pivots Ethereum Staking Strategy to Linea Layer-2 Amid Stock Decline

SharpLink Gaming, Inc. (SBET) shares fell 4.86% midday as the company announced a strategic shift in its $3.6 billion Ethereum treasury management. The gaming firm revealed plans to explore staking on Consensys' Linea layer-2 network, set to launch September 10, while maintaining existing staking arrangements with Anchorage and Coinbase.

The move signals SharpLink's ambition to diversify beyond traditional custodians and optimize yield generation. By joining the Linea Consortium, the company positions itself to participate in 75% of LINEA token distribution, leveraging the network's infrastructure for enhanced capital appreciation.

Market reaction was immediate, with SBET dropping from $15.43 to $14.68 before stabilizing. This treasury reallocation reflects growing institutional interest in layer-2 solutions as Ethereum's ecosystem matures.

Retail Investors Seek High-Potential Crypto Presales as Ethereum Whales Accumulate

Ethereum whales have been aggressively accumulating ETH since April 2025, driving its price from $1,400 to over $4,400 by September 4. Institutional inflows, including a $65 million purchase by BitMine Immersion Technologies, underscore growing corporate confidence. BitMine CEO Tom Lee projects ETH could reach $60,000, citing Wall Street's deepening crypto involvement.

Despite Ethereum's bullish trajectory, some retail investors hesitate due to its $533 billion market cap and perceived limited upside. This skepticism has fueled interest in alternative opportunities like DeepSnitch—an AI-focused project priced at $0.01634 during its presale, which raised $182,000 in its initial phase.

Ethereum traded at $4,300 on September 4, recovering from early-month volatility. Advocacy firm Etherealize further bolstered sentiment with a $40 million fund dedicated to promoting Ethereum's institutional adoption.

AIXA Miner Promises $2,500 Daily Ethereum Cloud Mining Profits Amid ETH's $4,200 Stability

Ethereum has solidified its position as the backbone of smart contracts and decentralized finance, with its price stabilizing above $4,200 in 2025. Investors are increasingly turning to cloud mining solutions like AIXA Miner, which claims to offer $2,500 in daily passive income through optimized mining contracts.

The platform addresses the barriers to direct Ethereum mining—high hardware costs, electricity expenses, and technical complexity—by offering managed cloud-based contracts. AIXA's infrastructure leverages Ethereum's dominance in Web3 development to deliver consistent returns without requiring physical mining operations from users.

Ethereum Whale Reawakens with 150,000 ETH Transfer to Staking Address

A dormant Ethereum whale has resurfaced after three years, moving 150,000 ETH—worth approximately $646 million—to a staking address. The transaction traces back to participants in Ethereum's 2014 ICO, where ETH was priced at just $0.31. These addresses had remained inactive since February 2022, signaling renewed confidence in Ethereum's staking ecosystem.

Similar movements have been observed recently. In August, another ICO participant transferred $19 million in ETH to Kraken, followed by an additional 1,060 ETH. Last month, a separate address moved 2,300 ETH to the same exchange. Such activity suggests early investors are capitalizing on Ethereum's current market position or preparing for further network upgrades.

Ethereum Price Prediction: Analyst Sees $10,000 Target Driven by Stablecoins and Tokenization

Ethereum's resurgence is gaining attention as Hashdex analyst Samir Kerbage projects a $10,000 price target, citing three catalytic drivers. The network now has 36 million ETH staked—representing a third of its supply—while real-world asset tokenization on Ethereum surged from $5 billion in 2022 to $24 billion by mid-2025.

Stablecoin payment solutions are emerging as a key growth vector, with Kerbage calling Ethereum a "sleeping giant" during its earlier consolidation phase. Institutional interest is accelerating, evidenced by ETHzilla's $100 million ETH allocation to Etherfi for restaking yields.

Generational wealth transfer adds macroeconomic tailwinds—over 50% of Gen Z holds crypto, with $100 trillion poised to shift to younger demographics. Ethereum currently trades at $4,400, up 83% year-over-year, as its ecosystem fundamentals strengthen.

Ethereum's Price Rally Contrasts with SpacePay's Utility-Driven Presale Success

Ethereum's upward trajectory continues as it approaches all-time highs, generating paper wealth for holders. Yet the cryptocurrency's fundamental limitation persists: scarce real-world spending utility. Merchants from coffee shops to retailers still largely reject ETH payments, compounded by network fees that frequently exceed small transaction values.

SpacePay's $1.3 million presale demonstrates demand for practical solutions. The platform enables instant ETH-to-fiat conversion at participating merchants, addressing volatility concerns and gas fee impracticalities. SPY tokens trade at $0.003181, deriving value from payment infrastructure rather than speculative appreciation alone.

The divergence highlights crypto's maturation phase - where price performance increasingly requires corresponding utility. While Ethereum dominates market cap rankings, projects bridging the gap between blockchain assets and commerce may capture the next wave of adoption.

Pepeto Emerges as a Standout in Crowded Crypto Presale Market

While BlockDAG dominates headlines with presale hype, savvy investors are shifting attention to Pepeto—a functional Ethereum-based project delivering tangible tools. The platform distinguishes itself with live demos of its zero-fee exchange, public audits, and transparent staking terms.

Pepeto's $6.5 million raise reflects growing demand, with its presale price holding near $0.000000150. Built on Ethereum mainnet for liquidity access, the project offers cross-chain bridging capabilities currently in development—a rarity among speculative presale projects.

NFT Trading Volumes Surge in August as Collector Demand Outpaces Sales Decline

NFT markets show resilience with a 9% volume increase in August despite a 4% drop in total sales, according to DappRadar. The divergence signals deeper collector engagement—fewer transactions, but higher average prices. Ethereum maintains dominance with 61% market share, while Base network claims third place through low-fee advantages and airdrop incentives.

Institutional adoption accelerates the momentum. Hï Ibiza's permanent NFT gallery, featuring digital works by Beeple and Mad Dog Jones, exemplifies real-world integration. Meanwhile, CoinGecko reports a 25% spike in 24-hour trading volume to $7.9 million, underscoring renewed speculative interest.

Is ETH a good investment?

ETH presents a compelling investment case despite near-term volatility. Current technical indicators show mixed signals with price below the 20-day MA but strong MACD momentum. Fundamentally, significant whale accumulation ($646M staked, 150K ETH moved to staking) and Layer-2 adoption provide strong support.

| Metric | Current Value | Signal |

|---|---|---|

| Price | $4,311.60 | Neutral |

| 20-day MA | $4,431.70 | Resistance |

| MACD Histogram | +94.14 | Bullish |

| Bollinger Support | $4,055.56 | Key Level |

| Whale Activity | $646M Staked | Very Bullish |

According to BTCC financial analyst James, 'ETH's combination of strong institutional accumulation, growing Layer-2 adoption, and positive long-term projections toward $10,000 makes it a solid investment for investors with medium to long-term horizons, though near-term volatility around $4,000-$4,800 should be expected.'